FEATURED WORK ON GLOVER

Here, you can get a detailed look at the work I have done on Glover so far and the impact of my work on the business as regards revenue, customers, and the business as a whole

Problem:

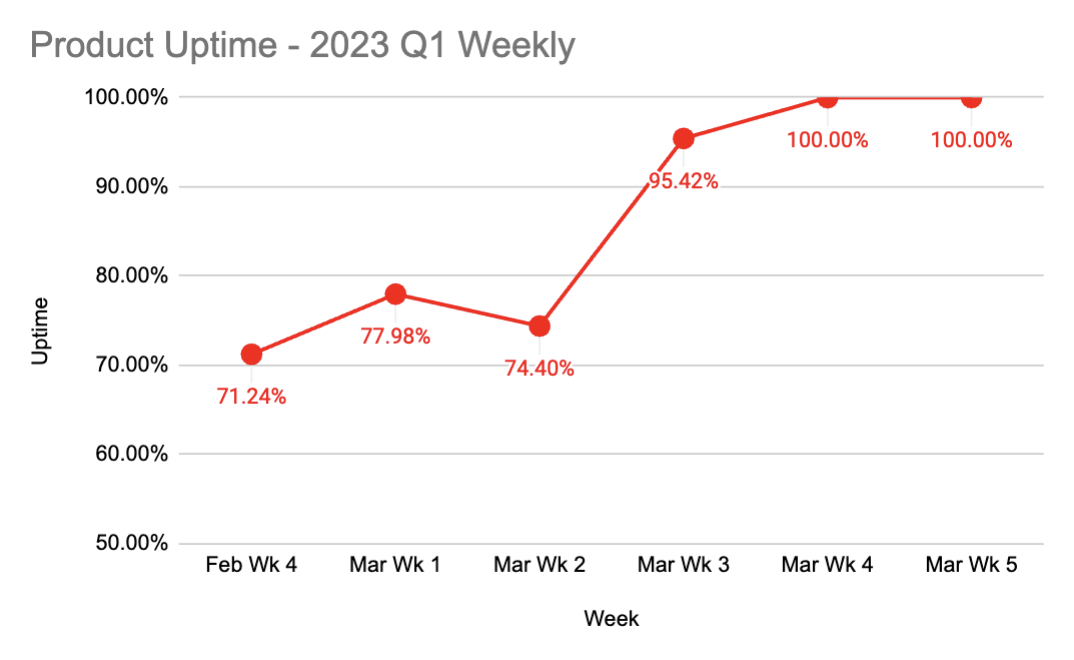

As I transitioned into the Associate Product Manager position, the Head of Product assigned a critical task to me: increasing the uptime of our Gift Card buy feature from 71% to 100%. This core functionality relied heavily on a major third-party provider. At the time, we had two Gift Card buy providers, but limitations imposed by Apple on the second provider meant only one could offer in-demand iTunes Gift Cards.

Despite my efforts to escalate the issue to the third-party provider and communicate the negative impact on user experience, churn rate, and revenue, the problematic provider couldn't resolve the problem. Recognising the urgency, I took the initiative to find a new solution to ensure consistent uptime and user satisfaction for this vital feature.

Solution:

To mitigate the impact of downtimes experienced by the gift card provider, I implemented a strategic solution within Glover's internal system Admin). This involved the creation of a centralized repository, termed the "Manual Pool," where bulk gift cards could be procured and stored during periods of provider uptime.

The technical implementation was designed such that when the gift card provider experienced downtime, the system would seamlessly draw and dispense gift cards from the Manual Pool to fulfil user-initiated gift card purchase transactions on our platform. This proactive measure ensured uninterrupted service delivery and minimised disruptions to our users, effectively addressing the recurring downtime challenges

GIFT-CARD BUY MANUAL POOL RELEASE NOTE

Results:

The implemented solution, deployed on February 9th, 2023, had a dramatic impact on gift card buy feature uptime. Uptime skyrocketed to a perfect 100%, as shown in the attached screenshot. This improvement translates directly to business success. In March, we saw a significant revenue increase of 4,100,000 Naira, alongside 991 additional successful gift card purchases.

The use of Gamification to improve retention and boost revenue

In 2023, Glover was faced with so many challenges ranging from an impacted decline in our customer retention rate due to the issues faced by the Parent company (Patricia), down to withdrawal issues due to low funds as well as a long list of other issues. This increased our churn rate and also reduced revenue.

To boost revenue and reward consistent users, I developed an MVP for a loyalty reward system based on gift card transaction volumes. The project followed these key steps:

Customer Validation: Conducted a survey among selected users, receiving positive feedback on the bonus concept.

Stakeholder Engagement:

Collaborated with the Head of Relations and Marketing Manager to refine the design and flow.

Consulted with the Head of Finance to set a 4.8% profit allocation for rewards.

Competitive Analysis: Strategically positioned our bonus percentages and thresholds above competitors to enhance market attractiveness.

The system works as follows:

Users are strategically segmented into ranks based on their gift card sell transaction volumes, drawing inspiration from gaming frameworks like Call of Duty and 2GO. Each rank offers progressively better rewards:

Transaction-based cash rewards: Users receive instant naira bonuses calculated as a percentage of each successful gift card sale, with higher ranks earning larger percentages

Premium support: Leader, Master, and Boss rank members gain access to dedicated account managers for personalized service

Competitive elements: The 'Boss' designation is awarded to the user with the highest gift card transaction volume, visible platform-wide to foster healthy competition

This targeted approach focuses on our highest-revenue product while creating multiple incentives for users to increase their transaction volumes. The visibility of the 'Boss' status particularly helps drive engagement through aspirational goals and friendly competition.

Launched on October 31, 2023.

Achieved a 37% increase in gift card transaction value in December 2023 compared to October 2023 and 53% in March 2024.

Grew revenue from giftcard sell feature alone from 458.8million naira in October 2023, to 663.8m in December, 2023 and 786.2m in March, 2024.

Achieved a 19.7% increase in gift card transaction value in November 2023 compared to October 2023.

Realized a 12% revenue increase in Q1 2024 compared to Q4 2023 for the gift card sales feature.

Read more about the Customer Reward MVP (Release note) 👉🏾 Click here

This initiative successfully drove user engagement and significantly boosted revenue, demonstrating the effectiveness of data-driven, user-centric feature development.I came up with the loyalty reward system (MVP) as a form of boosting revenue and rewarding our loyal and consistent.

Three months into my new role as an Associate Product Manager at Glover, a confluence of events occurred. The Senior Product Manager, commenced her three-month maternity leave, while the Head of Product resigned to pursue a more favourable opportunity. Although offered a contract role, the Head of Product's availability was limited. Remarkably, despite the presence of a mid-level Product Manager and another Associate Product Manager with more extensive experience in their respective roles, I was nominated to assume the interim positions of Product Manager for Glover and Acting Head of Product. While honored by this nomination, I initially harboured doubts about my ability to fulfil these responsibilities effectively. However, I resolved to embrace the challenge, reasoning that if the leadership had entrusted me with these roles, I possessed the capability to rise to the occasion.

Problem:

Checking through the different product metrics and the health of the product i realized that there was no transaction activity on the Ghana side, and after conducting a product test with a Ghana account i realised some flaws and the most prominent flaw was the outrageous fee charge for deposit transactions. It was so high that customers were not initiating deposits in other to perform various transactions across board.

I contacted our business manager in Ghana, Lordina, who informed me that our payment provider had been reaching out about our failure to meet the agreed transaction thresholds we had promised upon integrating their solution. I immediately scheduled a meeting with the representative from the third-party payment provider and key stakeholders from my team to address the issue. The provider was on the verge of terminating their service, and without a backup payment provider in Ghana, this would mean users would be unable to deposit funds into their wallets to perform buy transactions.

Following the meeting with the payment provider, they declined my proposal to reduce the deposit fee from 4.9% to 2.5% and proceeded to terminate the partnership.

Solution:

Faced with the terminated partnership, I took a proactive approach. I identified alternative Mobile Money (MoMo) providers and negotiated a significantly reduced deposit fee of 2% with my primary choice. Furthermore, I optimized the fee structure, securing an even lower rate of 1.9%.

Thinking ahead, I established a contingency plan by negotiating a competitive 2.0% fee with a backup provider. This comprehensive strategy secured both a primary and backup MoMo option at favorable rates, mitigating risks and ensuring uninterrupted service in Ghana

Fincra API integration for Ghana Deposit PRD

PawaPay API integration for Ghana Deposit PRD

Result:

The developers were able to integrate our deposit service for Ghana with these providers and deployed in September, 2023.

Following the production deployment of the implemented solution on September 18, 2023, we observed a notable increase in transaction volumes for gift card purchases and Perfect Money buy services, which are the available buy services for Ghana. Additionally, the fund deposit counts also exhibited an upward trend. This positive trajectory gained further momentum in November 2023, as evidenced by a substantial increment in transaction volumes across these service offerings, as illustrated in the accompanying image.

Problem:

During the second and third quarters of 2023, our platform experienced a significant decline in user acquisition and onboarding success rates. To investigate the root cause, I conducted user feedback sessions through surveys facilitated by the customer relations team. The survey responses revealed that a substantial portion of users were reluctant to provide any form of identification on our platform when their sole objective was to purchase airtime, data, gift cards, or subscribe to internet or TV services. This feedback validated the observed drop-offs occurring during the KYC verification stage of the onboarding process.

Solution:

To address the identified challenges, I implemented a strategic enhancement to the onboarding flow by segmenting users on the platform into two distinct levels: Level 1 and Level 2.

New users creating an account were designated as Level 1 users, granting them access to all buy-related products and services on the platform, including gift card purchases, Perfect Money purchases, personalised shopping(send- gift), and refill options. However, these users could only facilitate payments for the features they interacted with through the Flutterwave checkout integration. Access to wallet and sell features was restricted for Level 1 users, aligning with compliance regulations set forth by the Central Bank of Nigeria (CBN).

Users intending to interact with advanced features, such as gift card selling, Perfect Money selling, and Airtime-to-cash conversions, were required to provide a form of verification to qualify as Level 2 users. This tiered approach allowed for a balanced user experience while ensuring adherence to regulatory requirements.

Attached is a visual representation of the workflow diagram for the implemented solution

KYC LEVELS & LIMIT PRD

The implementation was deployed to production on the 18th of December, 2023 as seen in the screenshot below.

Results:

Following our launch on December 18, 2023, we saw significant user acquisition growth. New user signups increased by 31%, from 4,799 in December 2023 to 6,297 in January 2024.

Fully onboarded new users increased by 30%, rising from 1,706 in December 2023 to 2,225 in January 2024.